Members of NFRC (National Federation of Roofing Contractors) and other industry representatives were at the Houses of Parliament yesterday evening (5 July) to talk to MPs and Lords to improve their awareness of the problems caused for sub-contractors by cash retentions.

NFRC estimates that £300m of cash is held in retention just in the roofing and cladding industry.

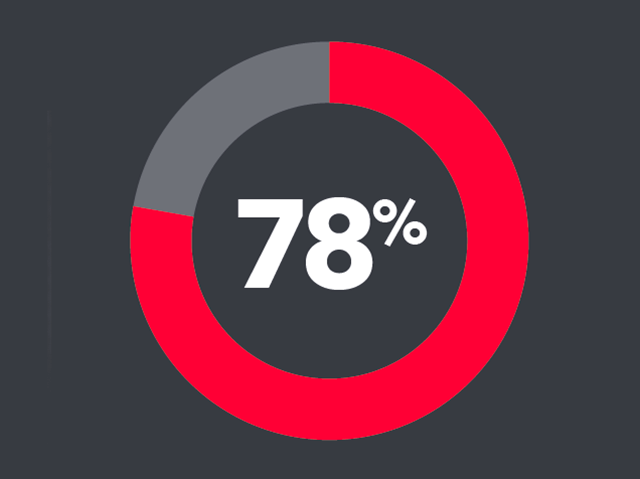

Despite efforts by some organisations in the wider construction industry to decrease the use of cash retentions, recent surveys of NFRC Members reveal that 78 per cent of contractors say they are facing levels of retention that are higher or the same as were seen a year ago.

The surveys also saw contractors call the process of chasing overdue retention payments ‘unnecessary’, ‘tortuous’ and ‘psychologically damaging’.

NFRC is calling on government to engage with sub-contractor organisations on the retentions issue, and inform them on why these firms would benefit from an end to the practice.

Andrew Lewer MBE MP, who is also Chair of the All Party Parliamentary Group on SME Housebuilders, hosted the reception.

Parliamentarians who attended the event were supportive of the message and recognised reports from contractors that retentions can contribute to serious financial difficulties. NFRC will continue to work with them to take the issue to government.

"At best, retentions are an extra burden on time-poor microbusinesses, at worst, they reduce sub-contractors to operating at a loss and sometimes even facing insolvency. Ending this practice would encourage business investment in skills and expansion by improving construction SME cashflow, freeing up hours of wasted time chasing owed monies, and reduce the number of sub-contractor businesses that decide they just cannot carry on. This outdated practice has persisted for long enough, and government should lead the way on bringing it to an end. Retaining skills and not cash has better outcomes all around.'"

James Talman- NFRC CEO

CASH RETENTIONS: £300m owed to roofing contractors

Government should:

- Revive and finish the incomplete policy development process following the 2017 – 2020 consultation, examining options on the retentions issue, including the option of abolition.

- Cease to include retentions in all public contracts from 2025. Some public bodies have already done this successfully. Crucially, government should also demand this of the whole project supply chain—where government have not held retentions on their contractors, those contractors should not be allowed to hold retention on their sub-contractors.

In the interim, it should:

- Publish public procurement guidance equivalent to the Scottish Government’s CPN 3/2022, outlining practices to ensure retentions are more proportionate to the work being undertaken.

- Take an active role in promoting Build UK’s minimum retention standards to the private sector. This set of standards that advises clients on approaching the practice more responsibly.

- Ensure that companies that report on late payments must also report on retentions, as considered in the 2023 Payment and Cash Flow Review. Clients with the worst record on paying back retention monies within agreed terms can then be ‘named and shamed’, allowing contractors to make more informed choices about the firms they work for.

James Talman, NFRC CEO, makes the case for moving away from retentions.

Our industry has been acutely aware for a very long time that cash retentions are a blight on roofing sub-contractor cashflow. NFRC’s most recent survey of roofing contractors saw individuals describe the process as ‘unnecessary’, ‘tortuous’, and even ‘psychologically

damaging’. At best, it’s an extra burden on time-poor microbusinesses, at worst, it reduces sub-contractors to operating at a loss and sometimes even facing insolvency.

So how did we get here?

Retentions are a legacy of the time when a company could easily ditch a job before completion and run off with little risk of repercussions. It goes without saying that we are no longer in that era. Sub-contractors operate under binding contracts to complete their

works including returning to fix defective elements, as well as providing warranties

and manufacturers’ guarantees. Retentions mean that on top of this, clients can hold a percentage of the contract value for a set period of time, and often are reluctant to pay up.

This is already a cashflow challenge, especially in an industry where many operate on small profit margins.

Following this, other challenges often emerge: sub-contractors report hours of wasted time chasing for payment after the agreed defects liability period has ended. If the client becomes insolvent whilst holding retentions, those subcontractors will never see a penny of the held money, despite having executed all of the agreed work. Construction

saw over 4000 insolvencies in the year to Q1 of 2023, the highest number of any sector monitored by the Insolvency Service. Forcing sub-contractors to wait years for monies from client companies contributes to the creation of a house of cards, in which insolvent clients can bring down their supply chain with them.

Roofing contractors want to invest in skills to retain and develop talent—their clients should not be preventing that.

When we asked sub-contractors earlier this year how they would use the extra cashflow if retentions ended, the same answers kept coming back: training and upskilling of the workforce, new technology and equipment, business expansion.

Ending retention would encourage business investment in skills and expansion by improving construction SME cashflow, freeing up hours of wasted time chasing owed monies, and reduce the number of sub-contractor businesses that decide they just cannot carry on. It would also reduce overall construction cost, because sub-contractors will not

have to build this risk into their pricing. This outdated practice has persisted for long enough, and government should lead the way on bringing it to an end.

We are often still undertaking works on other developments for the companies that owe retentions so don't want to damage relations or the potential of future works by taking legal action. The retentions that are held account for a very large percentage of the profit for that job.

Roofing SME: Yorkshire

£300m of sub-contractors’ cash held in retention at one time just in the roofing and cladding industry.

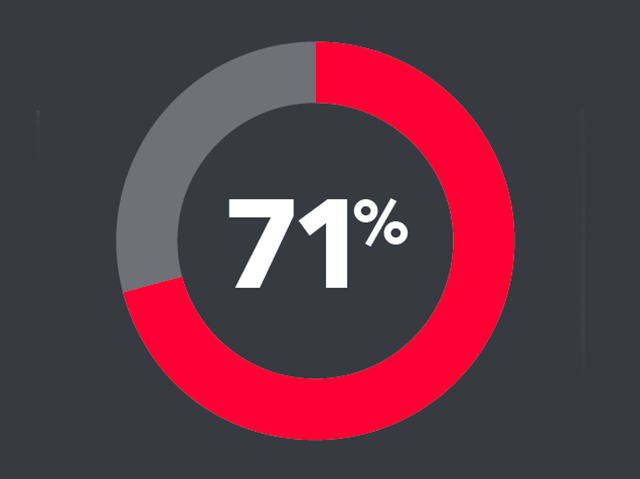

71% of NFRC Member roofing and cladding sub-contractors worried about the survival of their business.

78% of Member firms are facing more or the same levels of retention as last year, showing that impacts of voluntary schemes are not trickling down for roofing contractors.

You have to be extremely persistent for a successful outcome. This is

obviously very time consuming and for the return not always the best use of resources ideally.Roofing SME: North West of England

Work with NFRC to help make change. For guidance on how to help support NFRCs policy work on cash retentions, talk to us: policy@nfrc.co.uk